Since 1994, Frontier Airlines has operated. It’s well-known for its inexpensive flights. Among the locations the firms travel to are Mexico, the United States, and Canada. Despite Frontiers’ low ticket prices, several customers have expressed dissatisfaction with the amenities and services they received on the journey.

In the global investment environment, frontier markets are unique because they provide a medium ground between emerging markets and least developed nations (LDCs). We will examine the definition, dangers, and possible rewards of frontier markets in this extensive book. We’ll examine the term’s historical background and how these markets affect portfolio management techniques.

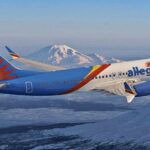

Read Also: Frontier flight ticket

As a halfway ground between emerging markets and least developed countries (LDCs), frontier markets have a unique place in the global investment landscape. We will look at the definition, possible rewards, and hazards of frontier markets in this extensive guide. We’ll explore the historical background of the word and examine how these markets affect portfolio management techniques.

even if they may not be satisfied with the services they received while traveling. Nevertheless, flying with Frontier Airlines is secure. For the most part, this airline is a superb option because of its excellent safety record and lack of catastrophic incidents. Frontier Airlines is ranked tenth because it is among the world’s safest and most stable airlines.

Definition and traits

According to Farida Khambata’s 1992 definition, a frontier market is a nation that, in terms of development, is between the least developed countries (LDCs) and emerging markets. Frontier markets are nevertheless worth investing in even if they’re smaller, less accessible, and have greater risks than established markets. These markets have the opportunity to yield significant long-term returns, which attracts investors; yet, this requires a delicate balancing act between stability and inherent dangers.

Possibilities and hazards

Frontier market investing is not without its difficulties. Among the dangers faced by investors include currency volatility, weak regulation, poor liquidity, subpar financial reporting, and political instability. However, risk-tolerant investors who are prepared to negotiate the complexity of these changing markets are drawn to the attractiveness of possible profits.

It is important to think about how technical developments affect frontier markets. Technology integration has the potential to change sectors, provide new investment possibilities, and affect market stability as these markets develop.

Investigating how frontier markets fit with environmental, social, and governance (ESG) standards is crucial given the increasing focus on sustainable investing. Making socially conscious investing selections can be aided by examining these marketplaces’ sustainability policies.

For investors looking to manage the risks involved with high returns, frontier markets provide a special opportunity. Making wise financial selections requires being educated and comprehending the intricacies of these markets as they continue to change. Frontier markets present an intriguing area worth investigating, regardless of your level of experience as an investor or your desire to explore new avenues.

Read Also: Frontier airlines seat selection